It appears as if you were billed points, yet they're covered by credit scores, implying you didn't pay for them expense. Make certain to contrast the price of the funding with as well as without mortgage points consisted of, across different funding programs such as standard offerings and FHA lendings. As you can see, a mortgage factor is just equal to $1,000 at the $100,000 funding amount level.

This fee ought to be divulged on your Funding Price Quote and also Closing Disclosure. They can be used to pay for shutting prices on the finance inclusive of source fees, title fees, assessment costs & recording charges. Unfavorable factors, which are also described as rebate points or lender credit reports, are the reverse of mortgage points. Rather than paying an in advance cost to reduce the rate of interest of the loan, you are paid an ahead of time charge to be billed a greater interest rate throughout of the loan.

- Smaller houses might see a greater origination charge on a percentage basis because the home loan broker will require to do a comparable amount of work for a smaller loan amount.

- 1 basis factor equates to 0.01% or 1/100 of 1%, so if you're adding 25 basis points, move the decimal over to the left twice so it becomes 0.25%.

- A basis factor is a handful that can have a large influence on the cost of funding a home.

A dimension (e.g. 1-year Treasury Expense) that is used when computing the brand-new rate of interest on an adjustable http://andresbtuk407.jigsy.com/entries/general/how-does-a-reverse-home-loan-work price home mortgage. A federal government sponsored enterprise which buys and securitizes home mortgages for resale in the second market and sets requirements for mortgage underwriting. The quantity transferred with a neutral third-party, called an escrow representative, that holds the customer's escrow settlements to pay out as well as distribute cash to correct celebrations involved in a real estate purchase. A basis point is a device of dimension that is made use of to define rate of interest fluctuations.

Various Other Points To Know About Mortgage Points

Noting of a legal file impacting title to real estate such as an act or home loan in a publication of public record. A decrease in the value of residential property due to physical or economic changes such as deterioration or any kind of various other factor; the reverse of recognition. A real estate project with numerous real estate devices where each device proprietor has title to an unit with undistracted rate of interest in the usual locations and also facilities of the project. The globe of financing is littered with industry-specific lingo that, for day-to-day consumers as well as capitalists, is frequently completely confusing.

Definition & Examples Of A Basis Point

It might represent a certain portion of the funding quantity, but have absolutely nothing to do with increasing or decreasing your price. Prior to this practice was forbidden, it was a common way for a broker to earn a compensation without billing the consumer directly. Nowadays, brokers can still be made up by loan providers, yet it works a little bit in different ways.

This can cause reduce regular monthly payments as well as decreased passion prices in the long term. Contrasting various loans with differing interest rates, loan provider fees, source fees, price cut factors, and also source factors can be extremely difficult. The annual percentage rate number on each lending price quote assists make it simpler for debtors to compare loans, which is why Click here! lending institutions are called for by law to include it on all lendings.

Identify your credit rating by requesting it from among the 3 significant credit scores coverage agencies; these ratings range on a scale from 300 to 850, with 750 being thought about an excellent grade. When percents and bps are made use of together, it is commonly to make clear an uncertain adjustment in circumstances. Navy Federal does not give, and is exempt for, the product, solution, total web site content, safety and security, or privacy policies on any exterior third-party sites.

When it comes to adjustable rate mortgages, it is the first rate of interest that is less than the amount of the index price plus the margin. Tiniest step in estimating returns on bonds, home loans, and notes, equal to one one-hundredth of one portion factor, or.01%. A bond whose yield to maturity changes from 8.50% to 9.25% is stated to relocate 75 basis points in yield.

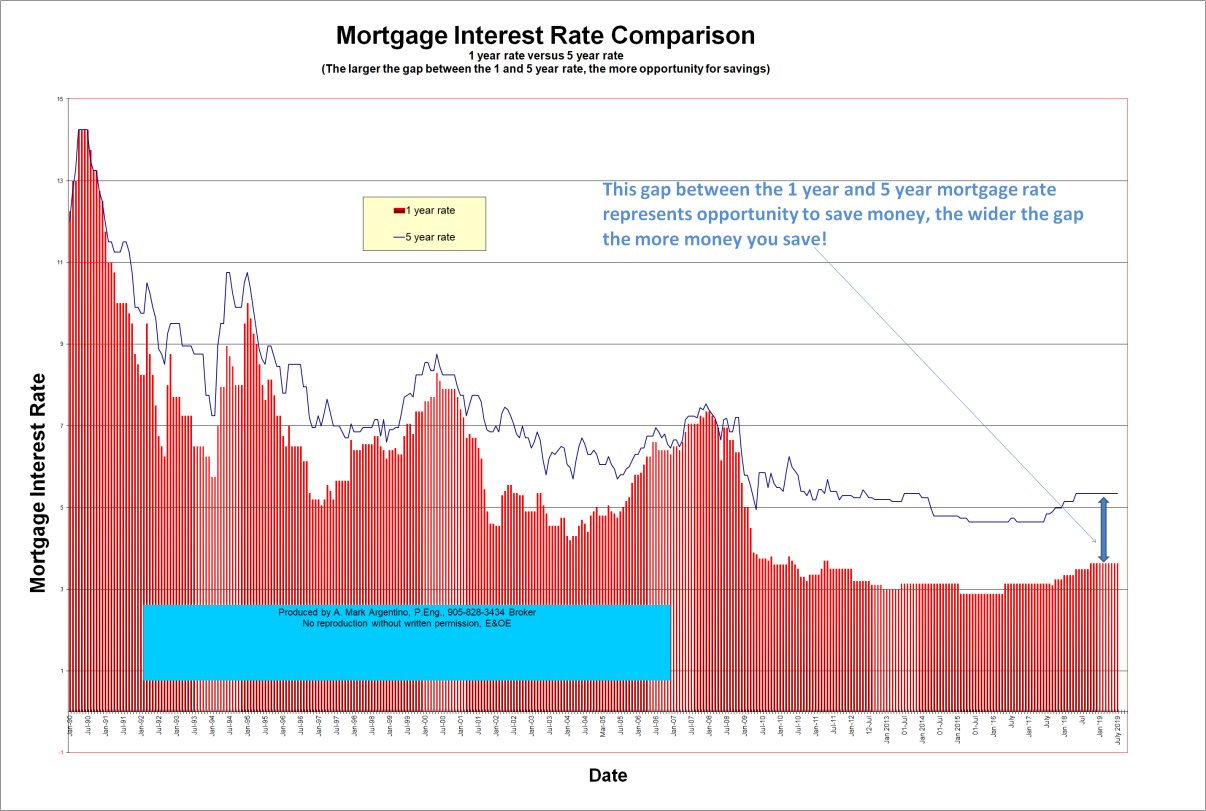

Home loan rates tend to "lag"-- be a Learn here bit behind-- various other market interest rates. Recognizing basis points could aid you, somewhat, forecast where home mortgage prices are going. If you are nearly prepared to make a home loan application, expertise of basis factors might aid you save some money. Basis factors are preferred with bigger investments such as bonds as well as home mortgages since little boosts or decreases in interest rates can stand for big dollars. Unless you operate in the world of finance, you may not be aware of the popularity of basis points.